GN Bank saga: Strange things have been happening after meeting Mahama – Ndoum

The political landscape in Ghana has been buzzing with speculation and intrigue following a meeting between Dr. Papa Kwesi Nduom, the Global President of Groupe Nduom, and former President John Dramani Mahama. This encounter, which took place on Friday, July 19, in Accra, has sparked a wave of controversy and raised eyebrows across the nation.

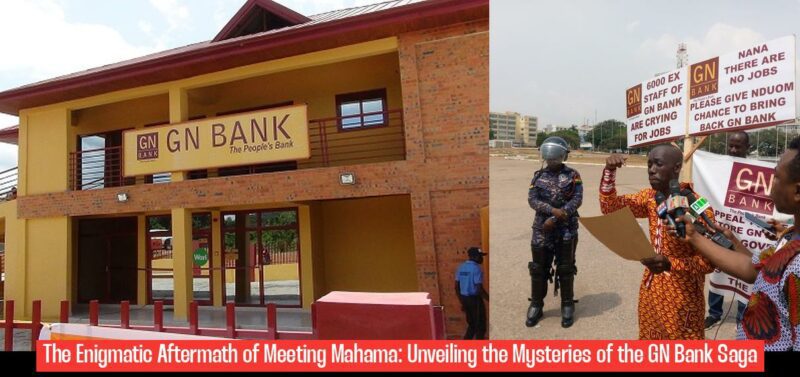

The crux of the matter lies in Dr. Nduom’s plea to Mr. Mahama to prioritize the reinstatement of GN Bank’s license if he wins the upcoming December 7 elections. GN Bank’s license was revoked by the Bank of Ghana in August 2019, leaving a trail of uncertainty and hardship for its customers and employees. Dr. Nduom, deeply concerned about the plight of the bank’s 300 centers across the country, believes that restoring the license would be a crucial step in alleviating the suffering of those affected.

Mr. Mahama, in his response, criticized the New Patriotic Party (NPP) government for its hasty decision to revoke the licenses of several indigenous financial institutions as part of the 2019 banking sector cleanup. He pledged to restore these licenses after an independent review of the entire exercise, signaling a potential shift in policy should he assume the presidency.

However, in the days following the meeting, Dr. Nduom has voiced his concerns about “strange things happening.” He alleges a deliberate scheme by NPP communicators to use Bank of Ghana statistics to discredit his claims that the government owes him a significant amount of money. This accusation adds a layer of complexity to the situation, casting a shadow of suspicion over the motives behind the alleged smear campaign.

A Tale of Two Banks and a Political Tug-of-War

The GN Bank saga is not merely a financial issue; it has become entangled in a political tug-of-war. Dr. Nduom’s petition to Mr. Mahama has ignited a fierce debate about the role of the government in the financial sector and the consequences of its actions.

Dr. Nduom, a prominent figure in Ghanaian politics, has long been a vocal critic of the NPP government’s policies. His meeting with Mr. Mahama, his political opponent, has been interpreted by some as a strategic move to garner support for his own political ambitions. This interpretation, however, overlooks the humanitarian aspect of his plea, which focuses on the plight of GN Bank’s employees and customers.

The NPP government, on the other hand, has defended its actions, arguing that the banking sector cleanup was necessary to ensure financial stability and protect the interests of depositors. The government’s stance has been met with criticism from some quarters, who argue that the cleanup was carried out in a manner that unfairly targeted indigenous banks.

This political back-and-forth underscores the complex interplay between finance, politics, and social welfare in Ghana. It highlights the challenges of balancing the need for financial stability with the protection of vulnerable stakeholders.

Unraveling the Truth: A Search for Transparency

Dr. Nduom’s allegation of a smear campaign against him raises serious questions about the transparency and accountability of the Bank of Ghana. He claims that the NPP government is attempting to manipulate statistics to undermine his credibility and mask its own shortcomings. This accusation, if proven true, would be a serious indictment of the government’s commitment to good governance.

The Ghanaian public is left to grapple with conflicting narratives and a lack of transparency. It is crucial that the Bank of Ghana provides a detailed explanation of its actions and the rationale behind the revocation of GN Bank’s license. This explanation must be grounded in facts and evidence, and it must address the concerns raised by Dr. Nduom.

Furthermore, an independent review of the entire banking sector cleanup exercise, as promised by Mr. Mahama, is essential to ensure fairness and accountability. This review should be conducted by a panel of experts with no political affiliation, and its findings should be made public.

Discover: Exciting New DC Comics Available This Week: June 25, 2024

The Human Cost of the GN Bank Saga

Beyond the political rhetoric and accusations, the GN Bank saga has a human cost. The revocation of the bank’s license has left hundreds of employees jobless and thousands of customers facing financial hardship. The ripple effects of this crisis extend far beyond the bank’s doors, affecting families, communities, and the local economy.

The plight of the affected individuals should be at the forefront of any discussion about the GN Bank saga. It is crucial to find a solution that prioritizes the well-being of those who have been impacted by the bank’s closure. This solution must involve a fair and transparent process that addresses the concerns of employees, depositors, and other stakeholders.

More related > Unraveling the Enigma of the Gorosei: Do They Possess the Ability to Swim?

Navigating the Uncertain Future

The future of GN Bank remains shrouded in uncertainty. The bank’s fate hinges on the outcome of the upcoming elections and the political will of the next government. Dr. Nduom’s plea to Mr. Mahama has raised hopes among GN Bank’s supporters, but it remains to be seen whether those hopes will be realized.

Regardless of the outcome, the GN Bank saga serves as a stark reminder of the fragility of the financial sector and the importance of good governance. It underscores the need for regulatory oversight, transparency, and accountability in financial institutions, particularly those that serve the needs of ordinary Ghanaians.

As the Ghanaian people prepare for the December 7 elections, the GN Bank saga is likely to remain a prominent issue in the political discourse. The outcome of this saga will have far-reaching consequences for the Ghanaian economy, and it will be closely watched by stakeholders both within and outside the country.

What sparked controversy in Ghana’s political landscape recently?

Dr. Papa Kwesi Nduom’s meeting with former President John Dramani Mahama on July 19 in Accra, where he pleaded for the reinstatement of GN Bank’s license if Mahama wins the upcoming elections, sparked controversy.

Why is Dr. Nduom concerned about the reinstatement of GN Bank’s license?

Dr. Nduom is concerned about the plight of GN Bank’s 300 centers across Ghana and believes that restoring the license would alleviate the suffering of affected customers and employees.

What response did Mr. Mahama give regarding the revocation of licenses of indigenous financial institutions?

Mr. Mahama criticized the NPP government for hastily revoking licenses of indigenous financial institutions in 2019 and pledged to restore these licenses after an independent review if he becomes president.

What concerns has Dr. Nduom raised after the meeting with Mahama?

Dr. Nduom has voiced concerns about “strange things happening” post-meeting, alleging a deliberate scheme by NPP communicators to discredit his claims that the government owes him a significant amount of money.